Articles & Videos

5 Growth Stages of Business and How to Finance Them

It doesn’t matter whether you’re in manufacturing or staffing, have one or fifty employees; the growth stages of a business look fairly similar for any organization. Understanding these phases and recognizing which one you’re in, can help you to understand where to concentrate your time and efforts and you will be able to manage financial resources and cash flow requirements more proactively.

Some of the stages you’ll go through in business are frustrating to say the least but if you have a measure on where you are and what success means at that particular stage, then the frustration element is lessened.

1. Launch into Existence

Possibly the most time and labor-intensive phase of a business is the start-up. Once the business is registered, then what? As an owner, responsible for everything, there’s a heavy burden of questions around how to find new customers, stabilize production and most importantly, will the cash run out?

Many start-ups lean on family, friends and their own personal assets to fund a new business but at this stage the expenses can seem unending and despite a really good concept, many business owners give up as they just weren’t expecting the demands placed on them, both financial and otherwise. Starting a business with at least 6 months’ cash flow projection allows a realistic view of where your revenues need to be, taking into account both ongoing and one-off expenses.

For those that persevere, they need to develop relationships with multiple finance partners perhaps, organizations that can help them to manage these early problems with cash flow unpredictability. Securing a traditional banking lender is a challenge for a new business as they will generally require a few years of trading history, a luxury that most just don’t have yet.

The most common complaint of business owners at this point is that expenses keep coming, nevertheless, if you can survive, as many do successfully, you’ve got a workable foundation to grow from.

2. Build for Success

Now that you’re servicing customers and they’re happy to continue buying your products or services, focus changes from survival to getting a better grip on revenues and costs and how they work together.

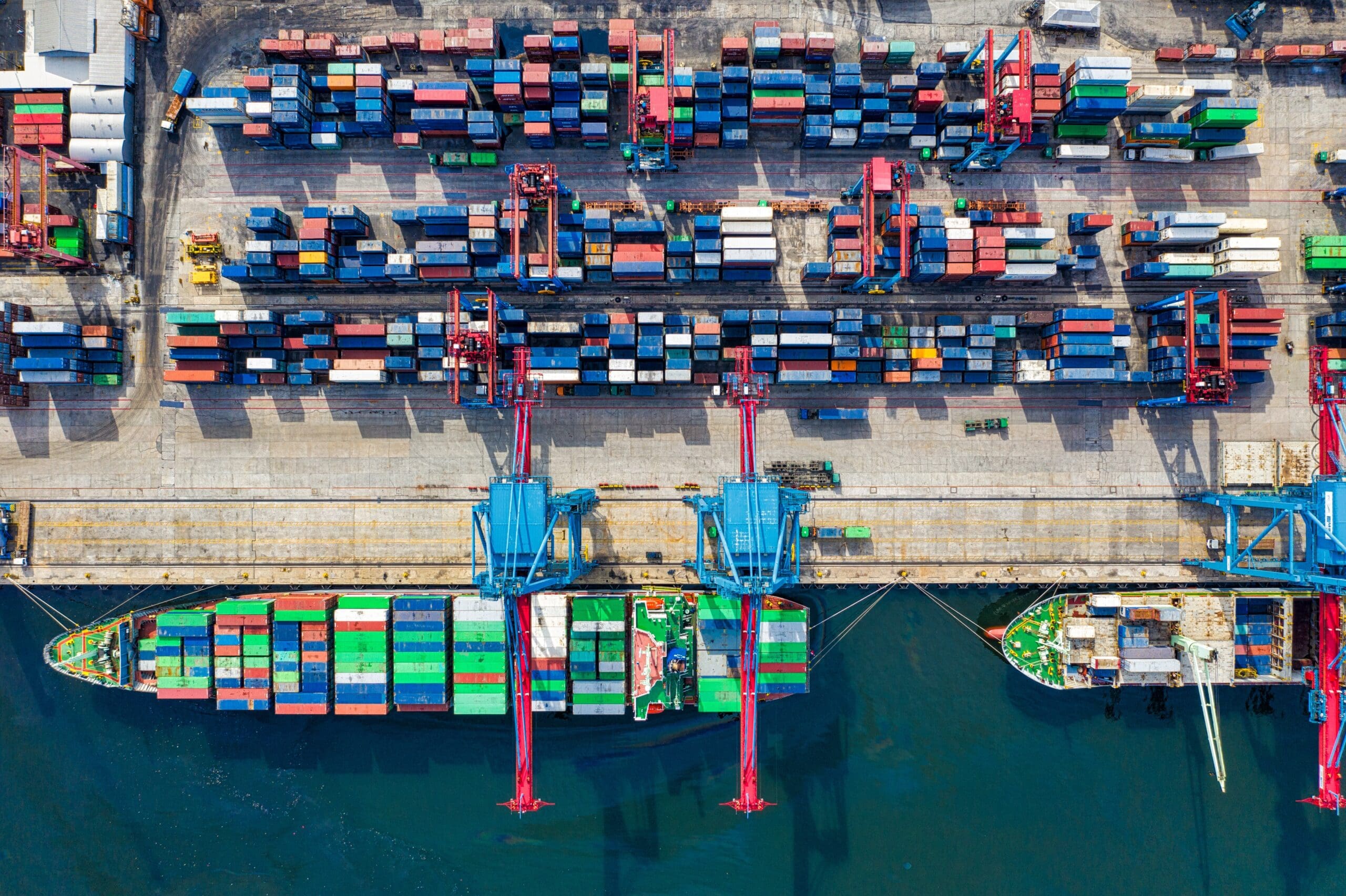

The difficulty here is that there has to be enough money coming in to both cover costs and allow for growth. If there is no plan to grow, you could find the business existing on marginal returns, only just covering costs. Quite often, businesses in the manufacturing industry for example, need a cash injection at this stage to be able to scale up operations and fulfil bigger orders, others might need capital to take on more employees or invest in increasing brand awareness.

3. Breakthrough

The move from survival in the building stage to a breakthrough is a significant point in a company’s growth. Usually during this period, the founder or founders have to step away from the day-to-day operations of the business which they’ve controlled so far and relinquish some decision-making to other functional employees in marketing or operations for example, so that the business can move forward to the next level.

Knowing when to adapt is key to moving on from this stage and management needs to recognize when it’s time to step back and change course to avoid staying in a situation for too long that it stifles growth.

Going for growth at this point will mean using cash, assets and other borrowing power to fund expansion. If you’re generating average profits, alternative financing options such as asset-based lending, equipment and supply-chain financing are all options available to you.

4. Take-Off (Finally in Profit Stage)

It’s taken some time (usually a few years), for most businesses to become profitable and now there’s a whole new set of challenges. This stage likely involves increasing channels to market, building resilience and warding off competition.

Competitors are always right behind you and by this stage, you’ll be looking at how to take a bigger stride away from them and this might be acquiring one of them or acquiring another, complementary business to your own goals. If this is in your growth plan, you’ll need to plan for the capital investment required. Whatever you decide, finances and a competent management team will be crucial to handle rapid growth.

Of course, you could also decide that you want to sell the company at this point and move on to another venture.

5. Mature and Scale

You’ve worked hard to grow your business to stability by this point and growth may still be there albeit a little slower. Financial resources and systems should be available now to work on eliminating inefficiency, streamlining processes and implementing strategic planning tools, however this has to be handled carefully so as not to stifle the entrepreneurial qualities that made the company what it is.

This stage is all about not standing still. Mature companies that fail to recognize opportunities to innovate or become more agile, increasingly run the risk of being overtaken in the market by their rapidly-growing competitors. Innovation done in a reactionary and ad-hoc way however, usually produces little to no ROI so the starting point must always be strategy.

Factors affecting the choice of business finance

Occasionally companies skip a growth stage which can cause confusion, but this is rare so being aware of where your business is situated in the cycle will allow more strategic planning. There are lots of options out there for financing a business at each of the stages we’ve covered and the right solution will depend on you and your business. The main things to factor into your decision will be;

- The type and structure of your organization;

- Overall cost of borrowing;

- The financial strength of your company;

- The extent to which you want to retain control of the business;

- What the funding is needed for and for how long, and;

- What level of flexibility is required from the lender?

This year has seen the rise of many startups in the FinTech industry itself, providing online finance to established SMEs and startups without the need for them to ever speak with anyone or step inside a bank. Moving away from relationship-based partnerships in banking is not without risk – will the company be around for the foreseeable future? It seems simple and quick to get access to their financial products but what are the loopholes and small print once you’re on board? Funding from a relatively new company can be attractive but make sure to consider all your options and find a way to ask questions.

Venture or private equity capital is sometimes used by startup businesses who can’t get access to other forms of finance. This form of funding can be expensive and unless you’re projected to grow at lightning speed and you don’t mind giving investors a big chunk of the business, this might not be the best fit.

Alternative financing options now available are filling the gap between traditional lenders and online lenders, offering tailored, flexible funding solutions with the knowledge that there’s always someone at the end of the phone who is genuinely interested in seeing your company succeed.

We’re proud to base our business on relationships – contact us to find out whether we can support the growth of your business whatever stage it’s at.

Search

News

Q1 2025 Funding Highlights

We’ve had a strong start to Q1, not just here in Scotland but across the UK – we’re proud to…

Read MoreQ4 2024 Funding Highlights

With 2024 all wrapped up, we’re proud to share a snapshot of the incredible businesses we’ve had the privilege to…

Read MoreArticles

Finding the Right Finance for Engineering

The economies of the US and Canada are heavily reliant on the success of the engineering sector which is a…

Read MoreIs US Manufacturing the Route to Economic Recovery?

There’s a big sea change underway in US manufacturing, the start of which predates the significant economic and political events…

Read MoreVideos

Popkoffs Client Testimonial

Popkoffs Client Testimonial

View NowWhat is Factoring?

Here we explain what exactly factoring is and how we can help your cash flow…

View Now