Newsroom

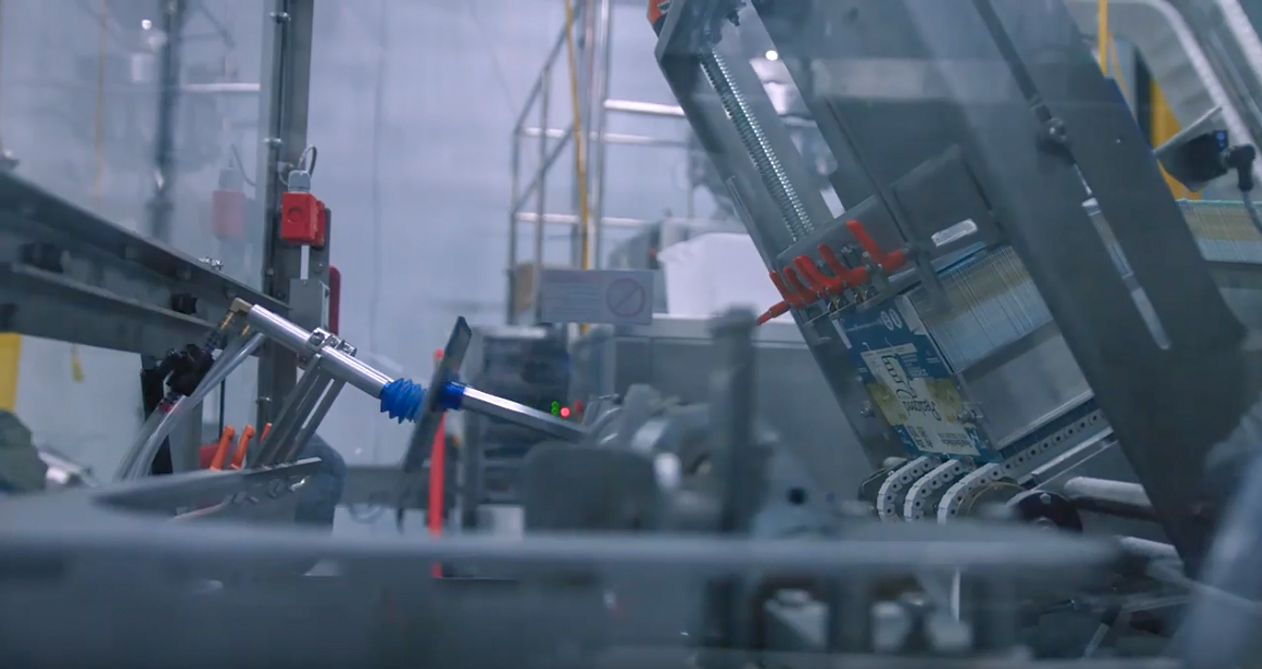

Sallyport helps boost Texas Chemicals Manufacturer with $7.5 Million in Funding

Sallyport commercial finance has provided a $6,000,000 million accounts receivable facility and $1,500,000 million inventory facility which will enhance working capital and facilitate the chemical and oil and gas manufacturer in progressing their growth plans.

The client was referred to Sallyport by a partner in the investment banking area, as their previous provider ceased the funding of inventory and intended to exit the relationship based on the industry. Sallyport were successful in securing the deal, working flexibly and collaboratively with a specialist in inventory lending and a financial consultant to structure a proposal that everyone was happy with.

The client was buoyed by Sallyport’s attitude to delivering a customized financial solution…

“We were extremely encouraged with Sallyport’s ‘can-do’ approach and we’re filled with confidence about the transition process as well as the day-to-day management of our account going forward. We are very much looking forward to working with the entire Sallyport team to grow our business to the next stage.”

Wade Concienne, Vice President, Business Development at Sallyport commented…

“Ensuring this deal came to fruition required a great deal of creativeness and the tenacity to find a solution befitting of the clients’ unique needs. With the guidance of an exceptional financial consulting firm and working closely with a specialized inventory lender, we were able to get the company refinanced and back on track to success. We are extremely excited to have the business on board and look forward to realizing great things together!”

Search

News

Q1 2025 Funding Highlights

We’ve had a strong start to Q1, not just here in Scotland but across the UK – we’re proud to…

Read MoreQ4 2024 Funding Highlights

With 2024 all wrapped up, we’re proud to share a snapshot of the incredible businesses we’ve had the privilege to…

Read MoreArticles

Pet Industry on a ‘Pawsitive’ Streak

Pets became priority again during the pandemic with owners forced to stay home to work and fill the void created…

Read MoreChallenges Facing Staffing Agencies Today

Staffing agency owners are emerging from the pandemic cautiously optimistic. After the major upheavals of last year, there seems to…

Read MoreVideos

Popkoffs Client Testimonial

Popkoffs Client Testimonial

View NowAG Machining Client Testimonial

AG Machining Client Testimonial

View Now