Newsroom

A Successful Turnaround for a Company in a Distressed Situation with Their Current Lender.

Sallyport Commercial Finance Assists with A Successful Turnaround for a Company in a Distressed Situation with Their Current Lender.

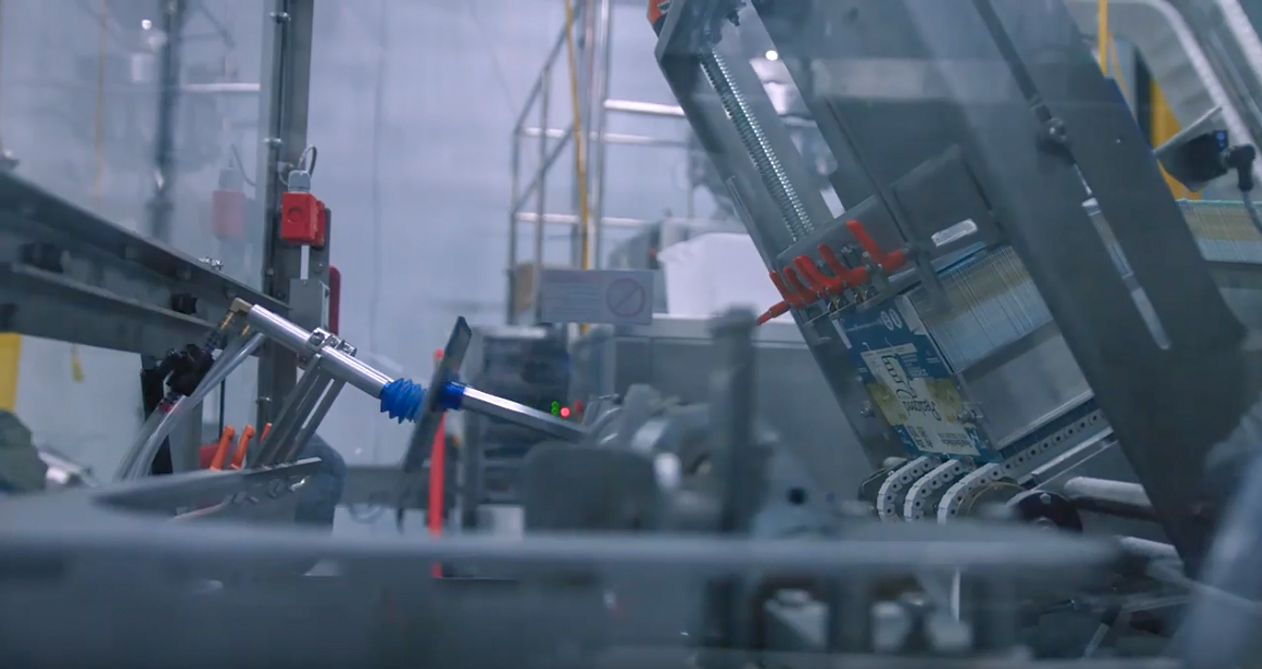

Florida – 8/31/18 – Sallyport Commercial Finance delivers a $7,500,000 combined credit facility that includes an Accounts Receivable Line, Inventory Line and Term Loan to a family owned apparel company with over 30 years of experience. The business breached several covenants with their current lender, and caused a contentious situation and lender fatigue that effected the ability for the business to continue to trade. The company found some direction and relief from their existing real estate lender who helped negotiate a settlement and then championed Sallyport to support their ongoing working capital.

“In difficult work-out situations, it’s imperative to work through the noise and seek out viable options to help a business stay relevant and continue day-to-day operations,” states Greg Dyson, National Sales Manager. “We’re confident in partnering with the business to ensure consistent and sustainable financing to help them reach their year-end obligations and prepare for a successful 2019.”

Sallyport Commercial Finance is delighted to provide a working capital solution so that this company can continue to grow their business and achieve their Hopes and Dreams. The company is now positioned to effectively manage the expectations of their clients, stakeholders, and suppliers in order to keep the business relevant for the coming years.

Sallyport Commercial Finance is an independently owned and operated specialty finance company focused on providing entrepreneurs with working capital solutions for small to medium sized businesses, to help drive growth and achieve business hopes and dreams. The senior management team have over 50 years of collective experience in helping entrepreneurs grow their businesses, both in the US and Europe, by turning their invoices and assets into cash. Sallyport Commercial Finance offers a full suite of factoring and asset-based products including Accounts Receivable Finance, Purchase Order Finance, Equipment and Inventory Finance, Cash Flow Loans, and Real Estate Loans. Very experienced in all our industries, our current portfolio includes businesses in Staffing, Energy, Food & Beverage, Apparel, Manufacturing, Service Industry, Transportation, Government Receivables and IT.

Search

News

Q1 2025 Funding Highlights

We’ve had a strong start to Q1, not just here in Scotland but across the UK – we’re proud to…

Read MoreQ4 2024 Funding Highlights

With 2024 all wrapped up, we’re proud to share a snapshot of the incredible businesses we’ve had the privilege to…

Read MoreArticles

2021 Year-End Financial Checklist for Small Business

Business owners are busy all year round but as the holiday season approaches, things reach a new level of hectic.…

Read MoreSuccession Planning – or Lack Thereof = Risk!

Succession Planning – or Lack Thereof = Risk! By Emma Hart Risk mitigation in our industry is, quite rightly, primarily…

Read MoreVideos

American Business Women’s Day

Sallyport Commercial Finance Celebrates American Business Women’s Day

View NowPopkoffs Client Testimonial

Popkoffs Client Testimonial

View Now