Articles & Videos

COVID-19: Catalyst or Concern for the Telecoms Industry

The telecoms industry is made up of diverse sectors and has so far suffered an equally diverse range of impacts from COVID-19. The sector is no stranger to a recession and in a way a ‘normal’ recession might have been easier to prepare for than the disarray that COVID has caused.

In the immediacy of the pandemic, the industry has seen huge growth in mobile data and voice demand from consumers and business owners restricted to working from home and conversely a drop in revenue from mobile data roaming that would normally be required by visitors, tourists and business travelers. On a business level, sudden declines were experienced as normal places of work shut down indefinitely and enterprise customers were forced to request suspension of their services or at least discounts or payment holidays to assist with their own liquidity challenges. Again, each sector is a tale of two halves as other B2B buyers such as retail looked to telecommunications providers for access to a broader range of services and improved connectivity so that they could adopt a more multi-channel business model.

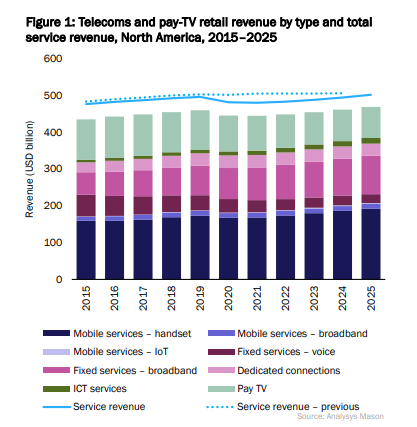

Source: Analysys Mason. Accessed 31.05.2021.

Considerations for the Telecoms industry

The telecoms market is set to grow by 6% up to 2025, largely driven by continued demand for data in both mobile and fixed networks and increases in fixed broadband connections as operators extend networks into rural areas.

Although growth is anticipated in specific sub-sectors, the industry needs to be prepared for all manner of scenarios that could stem from the pandemic in the mid-to-long-term; these scenarios will only become obvious when economies return to a level of routine and normality and this uncertainty is proving unhelpful for telco companies planning.

Loss of Revenue

- 5G Adoption

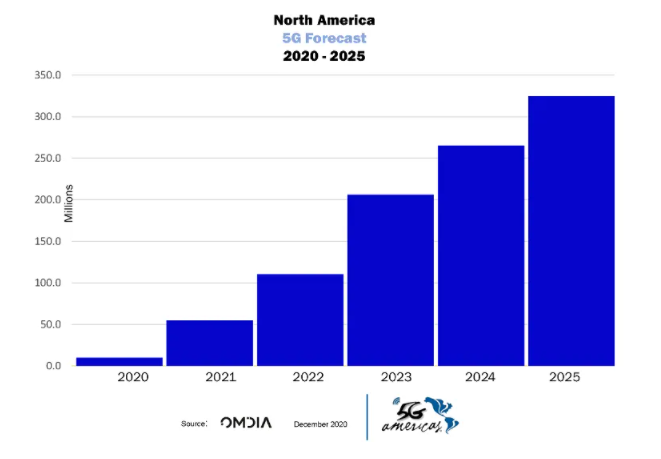

5G adoption was steadily increasing as more hardware came onto the market, spiking late 2020 when Apple applied it as standard to their entire iPhone 12 range. It’s believed that during this year, going into 2022, 3G will be phased out, replaced by 5G as the wireless standard with adoption happening at three times that of the rate of 4G.

Source: TeleCompetitor.com. Accessed 31.05.21.

While most businesses will agree with 5G as the way forward in improving reliability and speed, the uncertainty in the economy could result in telecoms companies revisiting their capital expenditure and deferring roll-out of the technology. On the other hand, resolute organizations may look on this as the ideal time to reposition and bring forward planned spend on their wireless networks regardless. They will need the cash to do this however and telecom businesses in the growth stage don’t have an easy time securing finance via traditional routes and can therefore be resigned to choosing between self preservation and an investment into their growth which would help them to capitalize on additional demand for digital services.

- Drawn-out lockdowns and recession

In the event of further lockdowns and a lengthier recession, it’s possible consumers will cut back on spend deemed unnecessary. Media and entertainment services are usually one of the first to be trimmed. Additionally, ongoing cancellation of live events and remote work only adds to unease around loss of advertising and B2B revenue.

At the moment, consumer products and services can be fragmented and standalone with a perception of quite often paying a premium package price for something that goes unused.

Telcos will need to examine their markets carefully and get a better understanding of what consumers really want and how they can advance with sensible convergences in their ranges, giving customers the flexibility to build customized packages rather than a ‘one-size-fits-all’ approach.

Success will mean putting customer needs first and moving away from reliance on a single value-line, in turn building resilience in the business whatever happens.

- Supply chain resilience

Not dissimilar to other industries, telecommunications businesses have been adversely affected by disruptions in their supply chain through the last year. One way of dealing with this was to stockpile inventory, particularly for those involved in infrastructure as they attempted to avoid competitive disadvantage and retain some clarity on future earnings.

A large debt ratio combined with loss of revenue can put any business into a cash flow constraint and this will need to be closely monitored. If they weren’t already, businesses will be looking at alternative supply sources to mitigate disruptions going forward and spread their risks.

Balancing cost and CapEx

COVID has once again highlighted the inequity in broadband connections for those on low incomes or in rural areas. Internet connectivity is not a nice-to-have – it’s now the only way to access jobs, health services and get an education and improving connectivity contributes to economic recovery. Telecom providers are an essential service and growth will happen as consumers and businesses’ needs for faster and better connections accelerate.

Growing in this climate will call for telcos to strike a balance between minimizing costs for a potential mid-term revenue decline and making sound investments in infrastructure improvements. CapEx on infrastructure will be required in some form, whether that be internally or through opportunistic plays to acquire the technology and capabilities needed to be able to play in both B2C and B2B markets.

Inaction not an option

Competition which has been limited previously, could now see some real disruptors enter the market as innovative startups take the opportunity to get in on the action now while others are postponing progress, preferring to wait and see what pans out.

In Canada, the telecoms market has been dominated by a few big players historically, however the Canadian Radio-television and Telecommunications Commission (CRTC) recently tried to introduce more competition by ruling that other telecoms providers would be able to use the networks of the ‘big 3’ in an attempt to drive more choice and affordable wireless access for consumers.

Finance solutions for the telecoms industry

Sallyport are well-versed in the unique financial needs of the telecoms industry and are ready to work with businesses looking to take advantage of market growth through investment, merger or acquisition. We have a wide range of financial products at our disposal, which we use to tailor solutions unique to clients’ needs. Our alternative finance products are without some of the restrictions that traditional lenders may have and can fuel growth without incurring further debt. We’re also a proud member of ‘The Communications Infrastructure Contractors Association’ (NATE), demonstrating our ongoing commitment to supporting the industry through COVID and beyond.

We’re always available to answer any questions you might have on growing your business – reach out today!

Search

News

Q1 2025 Funding Highlights

We’ve had a strong start to Q1, not just here in Scotland but across the UK – we’re proud to…

Read MoreQ4 2024 Funding Highlights

With 2024 all wrapped up, we’re proud to share a snapshot of the incredible businesses we’ve had the privilege to…

Read MoreArticles

Funding a Multifaceted Apparel Industry

The apparel industry is unique and not just with regards to the fashions you see hitting the catwalk each season.…

Read MoreWhat are the Biggest Risks to Business in 2021 and Beyond

If this was asked at this point last year, the response would be in major contrast as to the biggest…

Read MoreVideos

The Most Financial Time of the Year

Sallyport commercial finance’s Annual Holiday Music Video!

View NowAmerican Business Women’s Day

Sallyport Commercial Finance Celebrates American Business Women’s Day

View Now