Newsroom

Sallyport Agrees $1,600,000 Finance for Canadian Manufacturer

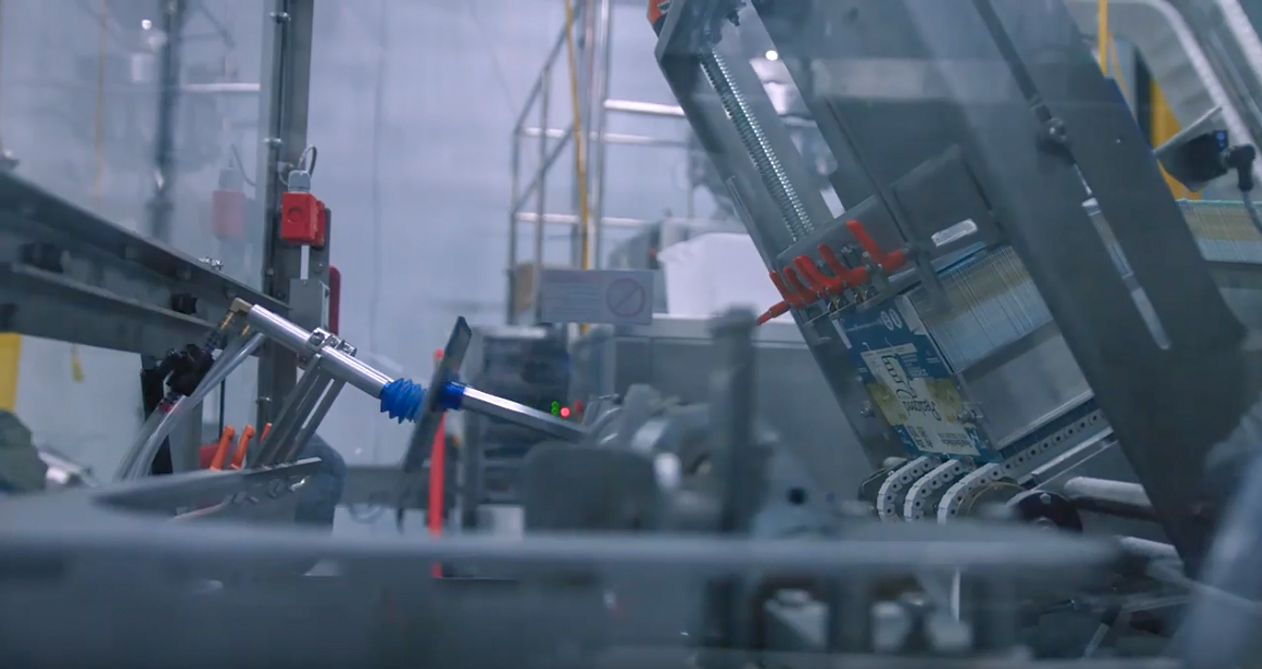

We’re excited to announce a $1,600,000 accounts receivable facility for a growing Canadian manufacturer in the agricultural space.

The client was referred to us by a broker and although there were other providers vying for the business, the client ultimately favored Sallyport’s responsiveness and flexible approach to finding a solution that worked for them.

The business had unfortunately incurred recent losses and frequently encounters issues collecting on their accounts receivable which had started to be felt in the impact to their cash flow. These funds will be used towards operational costs and have also allowed them to fulfill a profitable new contract. With the support of Sallyport, they can be very optimistic for the future and their growth prospects, which they hope might feature expansion into the US.

James Bartel, Senior VP for Sallyport stated…

“It was very satisfying to be able to help a Canadian company that has faced challenges but has many growth opportunities ahead. There’s never been a better time for companies that concentrate on innovative, energy-saving solutions and they just needed the right financial support to get them back on track. Sallyport came up with a flexible solution which supports the client in fulfilling a new contract. No one likes turning down work and SCF turned a no into a yes!”

Our client representative commented…

“Thank you Sallyport! We are looking forward to building a relationship with the team.”

Search

News

Q1 2025 Funding Highlights

We’ve had a strong start to Q1, not just here in Scotland but across the UK – we’re proud to…

Read MoreQ4 2024 Funding Highlights

With 2024 all wrapped up, we’re proud to share a snapshot of the incredible businesses we’ve had the privilege to…

Read MoreArticles

How Can Staffing Agencies Manage Labor Shortage?

It is becoming increasingly difficult for staffing agencies to meet the demands of clients by finding top talent. Many companies…

Read MoreA to Z of Small Business Finance and Credit Terms

Most small business owners go into business to follow a passion or create freedom in their career and lives. It’s…

Read MoreVideos

AG Machining Client Testimonial

AG Machining Client Testimonial

View NowPopkoffs Client Testimonial

Popkoffs Client Testimonial

View Now