Articles & Videos

UK Firms Consider Move Across the Pond

Over 6-months following the UK’s official exit from Europe and the implications for UK-based exporting businesses remain murky. Many larger companies have weathered the storm successfully, if they had the motivation to persist through new complexities to trading that is. On the other hand, it seems that SMEs without the necessary resources to navigate the changes have started considering a move closer to customers in Europe or even across the pond to save themselves the red tape.

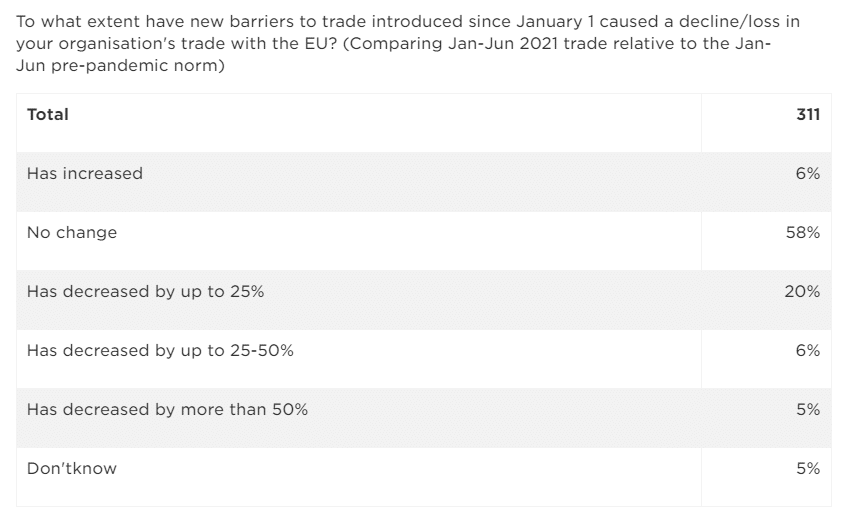

According to a survey conducted by the Institute of Directors, around a third of UK firms stated that the new agreement introduced on January 1 of this year had resulted in a loss or decline in trade for their organization with the EU.

Source: Institute of Directors. Accessed: 13.07.21.

Source: Institute of Directors. Accessed: 13.07.21.

The new trade agreement between Britain and the EU which finally came into force on January 1, 2021 allowed for continued free trade between the UK and Europe without any taxes or tariffs plus removed the decades of restrictions around common tariffs and shared regulations. From this it sounds like the long-awaited disunion was all on the UK’s terms.

Removing the formal ties of the union was the easy part, the new processes required to continue ‘business-as-normal’ would be anything but straightforward. Everything that was new about trading from laborious paperwork to cargo delays and restricted movement of labor all suggested the actual exit was aimless and uncoordinated, particularly for an SME sector already dealing with COVIID-19.

Navigating a complex new export process

In the first quarter of 2021, it’s thought that just 27% of exports that could have been exported under the zero-tariff, zero-quota agreement actually were and this was largely due to the complexities in claiming it. This amounted to 2.5bn Euros of eligible exports.

For many UK businesses, they had to become experts in exporting overnight, having been protected by free trade and movement even before their inception. Some of the many new obligations on UK exporters were;

- Assessing the regulations, restrictions and duties applicable in the destination country;

- Applying for an export licence or certificates If they’re exporting any kind of goods that fall into a ‘special’ group;

- Acquiring the relevant business export numbers from the government and registering for appropriate sales taxes;

- Checking that the importer is actually allowed to have the goods enter their country and whether they will need a special license themselves;

- Deciding on who will manage export declarations and ship the goods (will it be managed internally or will there be a need to hire customs brokers?);

- Allocating the correct export commodity classification for the goods;

- Sending the invoice and all relevant documentation with the goods including the licences, certificates and proof of origin to qualify for zero-rate duty;

- Creating processes for dealing with customs at both borders and in the event that goods are returned to you;

- Keeping detailed records for invoicing, customs paperwork and tax purposes.

There are potential pitfalls at each and every stage of the export process which also vary if the goods come out of Northern Ireland and it’s possible that small businesses in particular did not have the existing internal resources to successfully shoulder the responsibility. Many have found that exporting under the new agreement is simply adding unexpected costs to their bottom line.

These costs could have resulted from recruiting a dedicated team of export professionals, accruing additional expenses in wastage due to delays in shipments or returned goods (particularly in the food and beverage industry), warehousing additional inventory to accommodate delays or as mentioned, simply not knowing the process to qualify for zero tax and tariffs and not being able to claim them effectively. To qualify for zero-rate duty and escape quotas, there are onerous requirements on the exporter to prove the origin of all of the components of their products to demonstrate that the majority derives out of the UK or EU and this has been somewhat of a challenge for small businesses to address in a timely manner.

UK firms on the move and not just to Europe

High profile firms such as Philips, Dyson and Ford have already made their exit from the UK. It’s not just the big-hitters that are on the move either, many smaller firms may also be considering moving their operations as the cost of doing business with the EU has become prohibitive. For one cheese manufacturer in the UK, post-brexit fees meant 20% of their business was wiped-out as the cost of paperwork to get a single pallet of product into each European destination rocketed to £180.00. With an average online sales order of £30, it simply became untenable to continue. As their product has protected designation of origin status and can only be produced in three UK counties, the company has looked to establish in new markets in the US and Canada, taking advantage of a surge in US consumer sales and a recent big trade deal with a Canadian customer.

Setting up manufacturing or distribution hubs is another option for UK businesses looking to diversify away from the European Union and while that can sometimes be complex and lengthy you don’t always have to dedicate time and resources in setting up a legal entity for your business immediately. If you’re starting up a business or creating a subsidiary where you can hire US or Canadian-based employees in the preferred location, this can reduce the time, tax and other implications of setting up as a foreign entity; experienced tax and legal professionals will be best placed to advise on the best course of action for your specific situation.

Aside from the many sectors of the food industry that could benefit from a more global UK trade policy, there are several key products and services that would be welcome additions to the North American market especially if the UK government succeeds in agreeing a free trade agreement with mutual reductions in trade tariffs which would offset higher delivery costs perhaps. A big share of UK exports to the US are for products used in the supply chain so it’s in the interests of both countries to agree deals that can offer them both a more resilient supply chain in the current climate.

Financial Solutions for Global Needs

Sallyport Commercial Finance understands how companies operate in global markets and have far-reaching financial services to meet all import and export needs. Import and export financing, purchase order financing and asset-based lending may be tailored as required to help your business relocate, open a subsidiary location and recruit and market your products and services in a new country. Reach out today to discuss your plans for expansion and let us demonstrate how we can succeed together.

Search

News

Q1 2025 Funding Highlights

We’ve had a strong start to Q1, not just here in Scotland but across the UK – we’re proud to…

Read MoreQ4 2024 Funding Highlights

With 2024 all wrapped up, we’re proud to share a snapshot of the incredible businesses we’ve had the privilege to…

Read MoreArticles

How Can Staffing Agencies Manage Labor Shortage?

It is becoming increasingly difficult for staffing agencies to meet the demands of clients by finding top talent. Many companies…

Read MoreGet to Know Anthony Guest in our First Employee Spotlight

What would you rate 10 / 10? White Island Resort , Ibiza – Super Venue , Super Food, Super staff.…

Read MoreVideos

Popkoffs Client Testimonial

Popkoffs Client Testimonial

View Now